The hidden costs of buying a home

Saving for a deposit and making monthly mortgage repayments are the big-ticket items that most of us are aware of when it comes to buying a home. But there are a handful of other costs that you need to consider when deciding to get on the property ladder.

Let's look at some of the other fees that may be payable when purchasing a property.

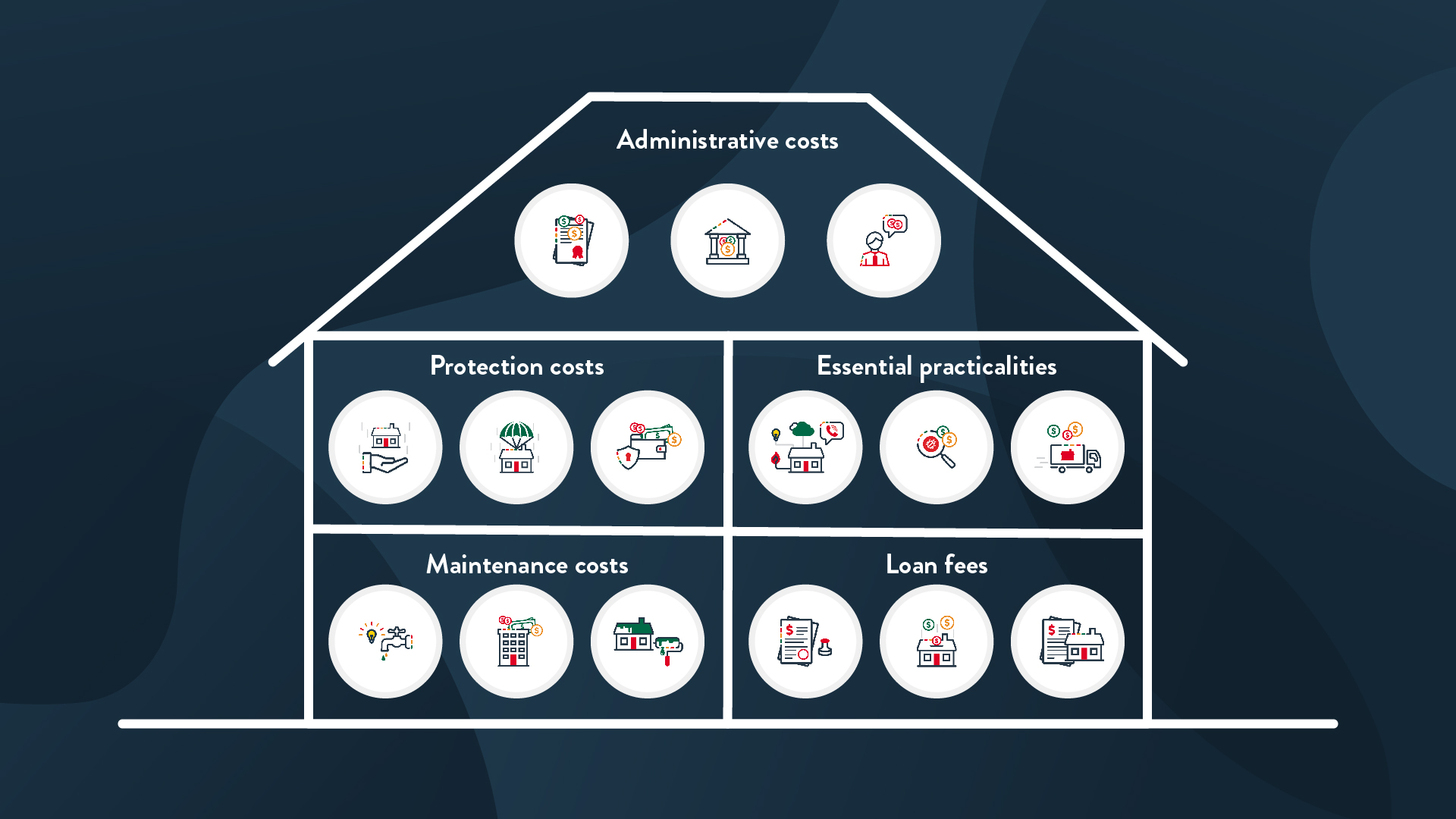

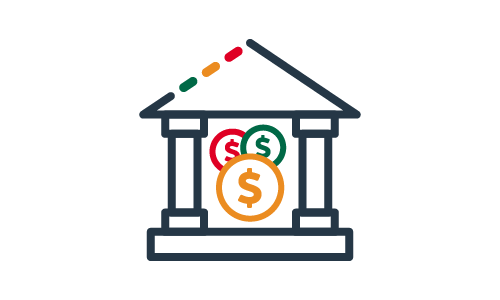

Administrative costs

Legal Fees

You’ll need a solicitor or conveyancer to do the documentation for buying your property.

A Land Information Memorandum (LIM) Report

This council-produced document provides a neat summary of all information the council currently holds on your property. From rates owing to stormwater drains or other building permits. It can be handy to ensure any work on the property is council-approved.

Buyer’s agent fees

Fees vary with the services, but you’re looking at paying an engagement fee in advance, or a percentage of the purchase price of the property you buy.

Protection costs

Risk Fee

You might be required to pay a risk fee, like LMI, if you are unable to put down a deposit of at least 20% of the property purchase price.

Home insurance

Home insurance covers the cost of loss or damage to your home. It’s also often bundled with a contents insurance policy that protects your possessions from loss or damage. Talk to your insurance provider to work out the right amount of cover.

Income protection

Income protection insurance allows you to keep up with your payments for a certain period, in the event of loss of income if you’re injured or ill.

Another option is mortgage protection insurance that can cover your home loan repayments in certain circumstances, if you can’t repay your home loan.

Essential practicalities

Utilities and connections

You’ll need to put aside a certain amount to connect your water, electricity and gas, as well as things like a phone line and internet.

Inspection

(building and pest)

It pays to inspect the property before you buy - a qualified inspector can spot potential problems that you might have overlooked.

Moving costs

The cost of moving house is something to think about. You can opt to do the heavy lifting with the help of friends and family, or pay for removal services.

Maintenance fees

Council and water rates

Building and property owners pay council and water rates to the state government, so they vary depending on where you live. Think of these fees as your contribution to the upkeep of your neighbourhood.

Strata fees

If you own a unit in an apartment block, you’ll need to pay strata fees, which go towards general management of the building and the complex’s common areas.

Strata fees can amount to a pretty significant sum, and vary depending on where you live and the type of building you live in.

Renovation

If needed, you’ll also need to factor in the cost of renovating your home before – or after - moving in. Make sure you weigh the cost of renovation against what you’re paying to buy the home.

Maintenance fees

Home loan fees

When you take on a home loan, you might be required to pay:

• A loan establishment fee.

• A valuation fee for the lender to assess the value of your home.

• A discharge fee, if you are exiting a prior home loan agreement.

Mortgage repayments

You’ll need to make your mortgage payments at least once a month. The sum you’ll pay depends on your loan type, your lender, and the amount you borrow.

Use our Mortgage Repayments Calculator to determine how much your repayments might be.

Loan administration fees

Many lenders charge a ‘service’ or administrative fee that accompanies each of your mortgage repayments.

You are protected by responsible lending laws. Because of these protections, the recommendations given to you about home loans are not regulated financial advice. This means that duties and requirements imposed on people who give financial advice do not apply to these recommendations. This includes a duty to comply with a code of conduct and a requirement to be licensed.

All loan applications are subject to the lender completing responsible lending checks and considering the borrower’s individual circumstances. Terms, conditions, fees and charges apply. Information provided is factual information only and is not intended to imply any recommendation about any financial product(s) or constitute tax advice. If you require financial or tax advice you should consult a licensed financial or tax adviser.

© Pepper New Zealand Limited NZBN 9429031065153 | NZ Company Number 3416551